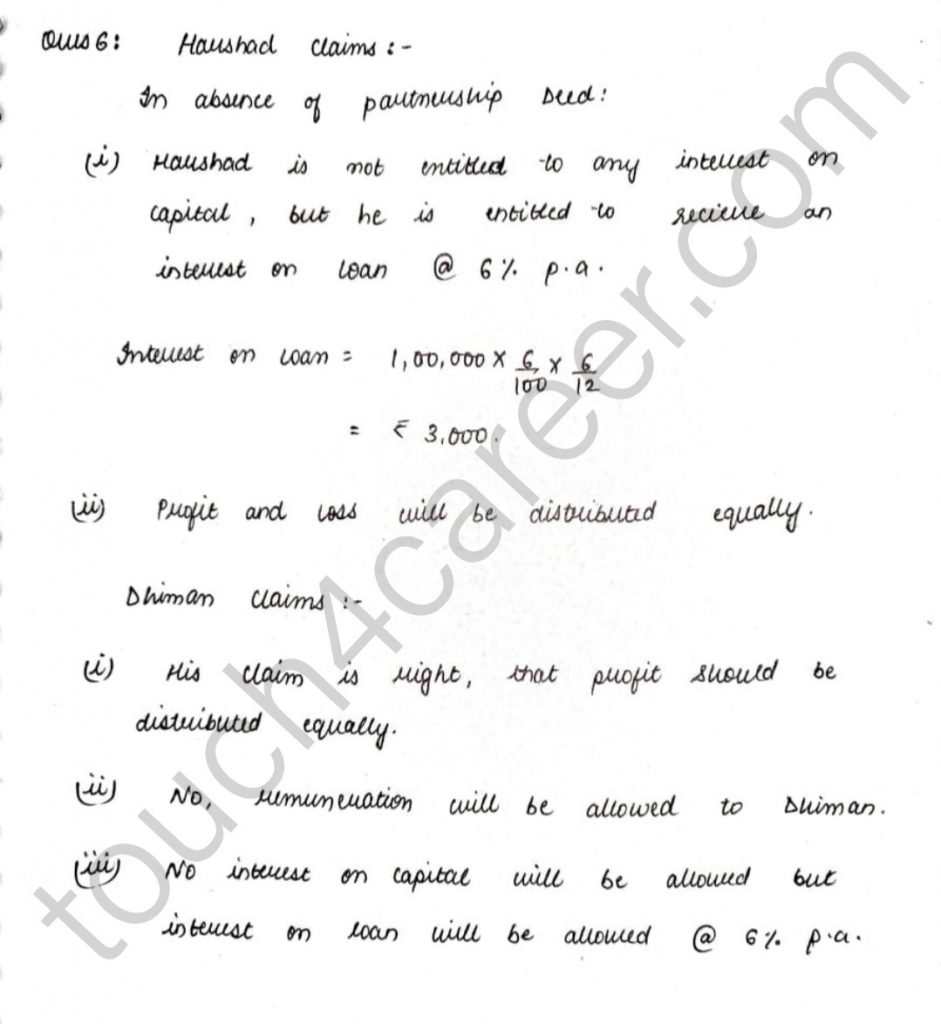

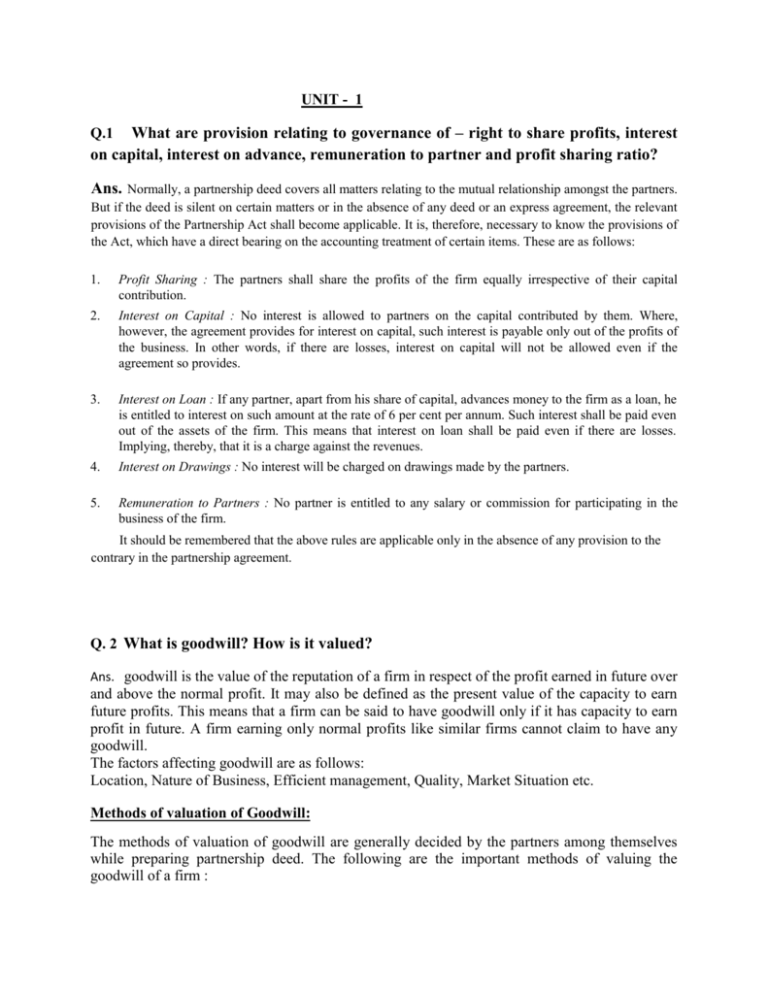

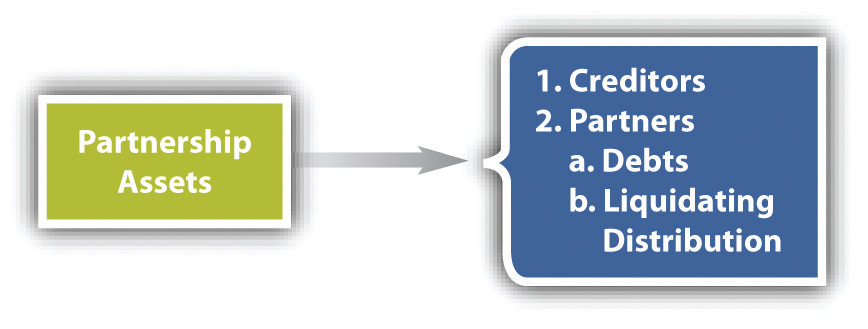

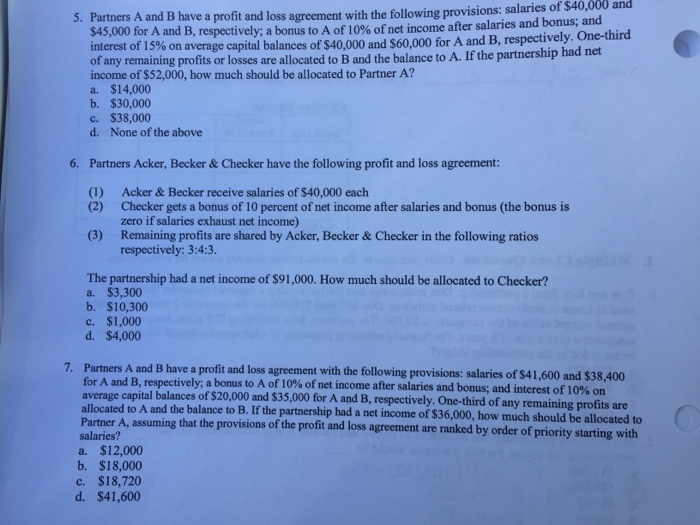

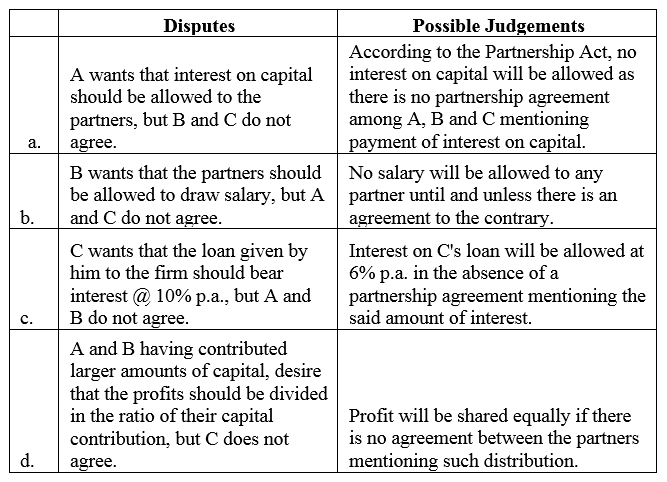

In the absence of partnership deed partners are entitled to >> Class 12 >> Accountancy >> Accounting for Partnership Basic Concepts >> Nature of Partnership RULES APPLICABLE IN THE ABSENCE OF PARTNERSHIP DEED As we know from the previous discusion that it is not cumpulsory to have a partnership deed for a partnership firm Hence if a firm is not having any written agreement or a partnership deed or if partnership deed is there but it is silent on certain issues the following provisions of the Indian Partnership Act 1932(A) 5% per year (B) – 6% per year – 12% per year (D) No interest is allowed 59 In the event of fluctuations in the partner`s accounts, the following positions/posts are recorded on the capital accounts page (A) Capital interest (B) Partner salary Partners` Commission (D) All 32

Revisor Mn Gov

In absence of partnership deed partners are entitled to what percent of profit as salary

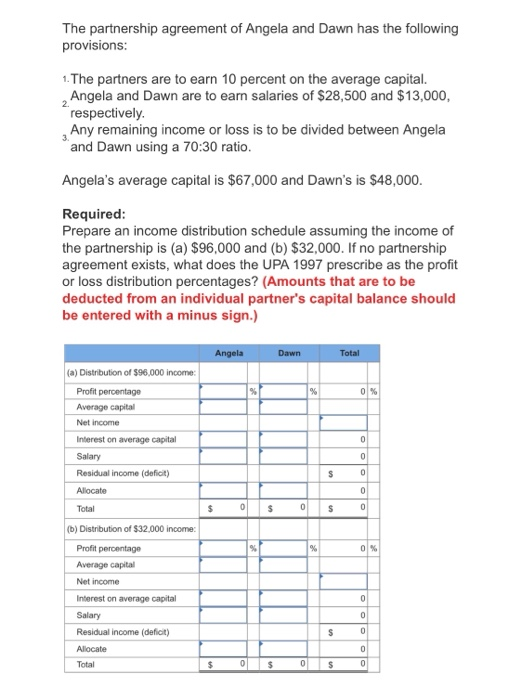

In absence of partnership deed partners are entitled to what percent of profit as salary- 4 In the absence of partnership deed, the partner will be allowed interest on the amount advanced to the firm by him at the rate of (A) 6% (B) 6% pa 12% (D) None of these Answer 6% pa 5 In partnership firm, profits and losses are shared—(A) Equally (B) In the ratio of capitals As per Agreement (D) None of these Answer As per Agreement 6 Mention the amount of partners' salary and interest on capital which should be debited to the Profit and Loss Appropriation Account if both items are treated as appropriation Answer Answer Partners' salary ₹ 11,250, Interest on capital ₹ 18,750 Note In the ratio of salary and interest on capital ie 12,000 ,000 = 3 5

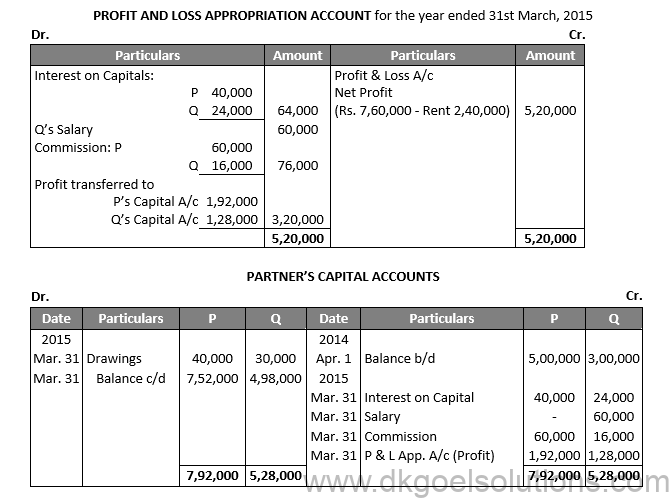

Dk Goel Solutions Class 12 Chapter 2 Free Study Material

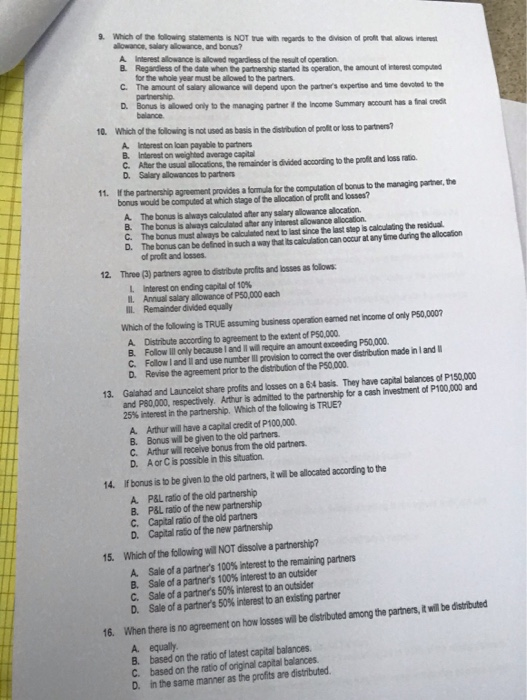

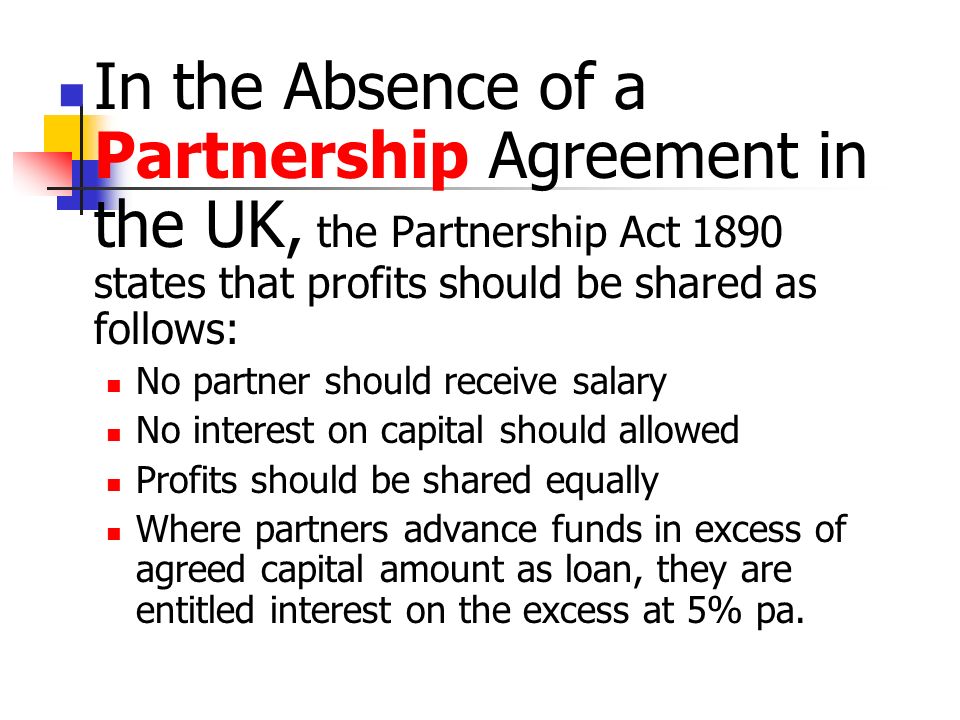

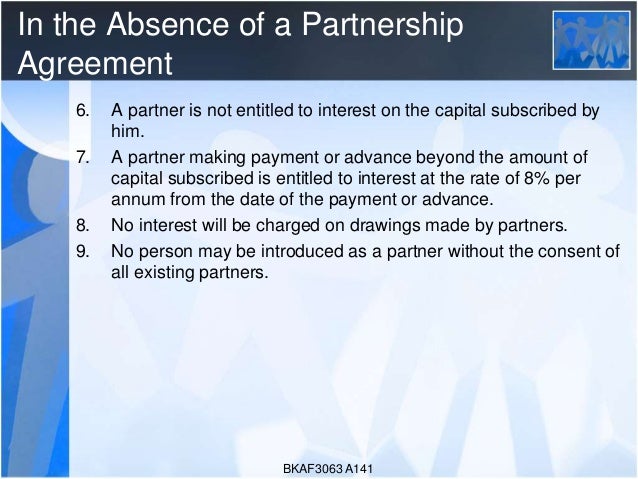

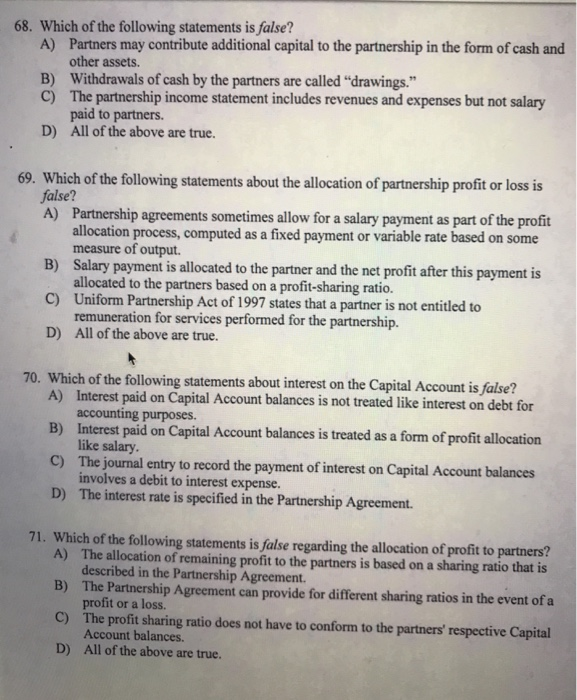

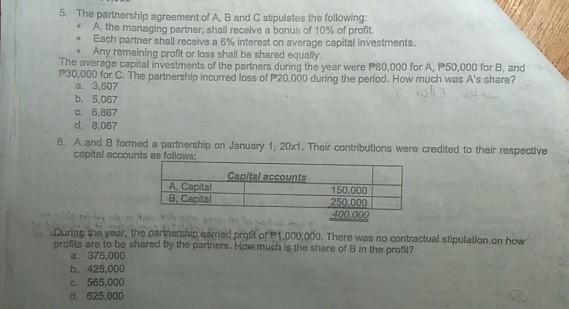

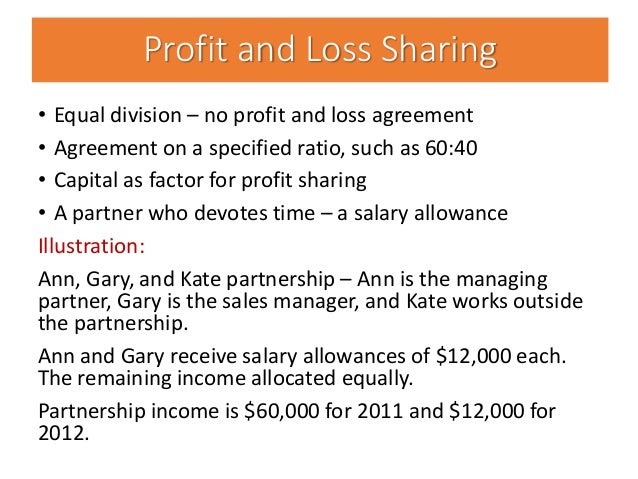

(iv) Interest on Partners Loan In the absence of partnership deed if partner gives any loan to the firm he/she will be entitled to get a fixed percentage of interest @6% of annum (v) Salary of Partner In the absence of the partnership deed a partner will be entitled for getting any salary for his work even if the others are non working In the absence of partnership deed, the partner will be allowed interest on the amount advanced to the firm (a) @5% (b) @6% (c) @ 9% (d) @8% Answer Answer (b) @6%In case of partnership deed is silent then section 2 of the Partnership Act 1932 will apply according to the Section partners are not provided with remuneration it is clearly mentioned that unless there is an agreement between the partners to the contradiction of section the partners are not eligible to have a remuneration for their contribution towards the firm moreover they cannot demand even interest on capital however there is a provision for loan by the partner which is 6% per annum

In the absence of a partnership decision, interests on the partner`s capital are allowed (CPT;3 Salary/ Commission to partner No partner is entitled to salary/ commission from the firm, unless the partnership deed provides for it 4 Interest on loan If any partner, apart from his share capital, advances money to the firm as loan, he is entitled to interest on such amount at the rate of six percent per annum 5 In the absence of any deed of partnership Only working partners are entitled to Salary Partners are entitled for commission @ 6% of the net profits of the firm Partners contributing highest capital is entitled for interest on capital @ 6% pa

In the absence of partnership deed, no interest is charged on drawings In the absence of partnership deed, partners are not entitled to receive a) Salaries b) Their profit sharing ratio is 3 2 Salary payable to A and B is Rs 2,000 and Rs 3,000 respectively The firm's net profit during a year is Rs 4,000 Partners are not entitled to receive in the absence of partnership agreement asked in General Introduction of Partnership by Umesh01 ( 658k points) general introduction of partnership (i) Sharing of profits and losses If the partnership deed is silent on sharing of profit or losses among the partners of a firm, then according to the Partnership Act of 1932, profits and losses are to be shared equally by all the partners of the firm (ii) Interest on partner's capital If the partnership deed is silent on interest on partner's capital, then according to the Partnership

Partnership Deed Its Importance And Rights Of Partners Accounting Finance

General Partnerships Explained The Business Professor Llc

(i) Sharing of profits and losses If the partnership deed is silent on sharing of profit or losses among the partners of a firm, then according to the Partnership Act of 1932, profits and losses are to be shared equally by all the partners of the firm (ii) Interest on partner's capital If the partnership deed is silent on interest on partner's capital, then according to the PartnershipIn the absence of partnership deed, the following rule will apply (A) No interest on capital (B) Profit sharing in capital ratio Profit based salary to working partner (D) 9% pa interest on drawings 24 In the absence of agreement, partners are not entitled to (A) Salary (B) Commission Equal share in profit (D) Both (a) and (b) 25

Partnership Operation And Termination

Solved If The Partnership Agreement Does Not Apportion Chegg Com

General Partnerships Explained The Business Professor Llc

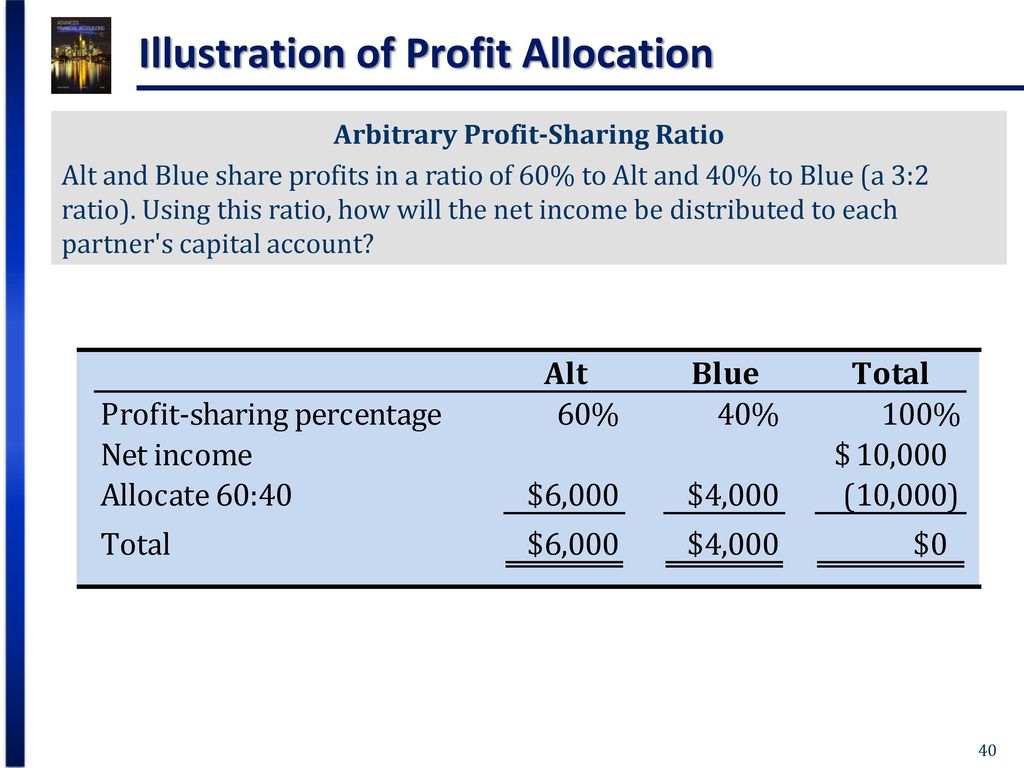

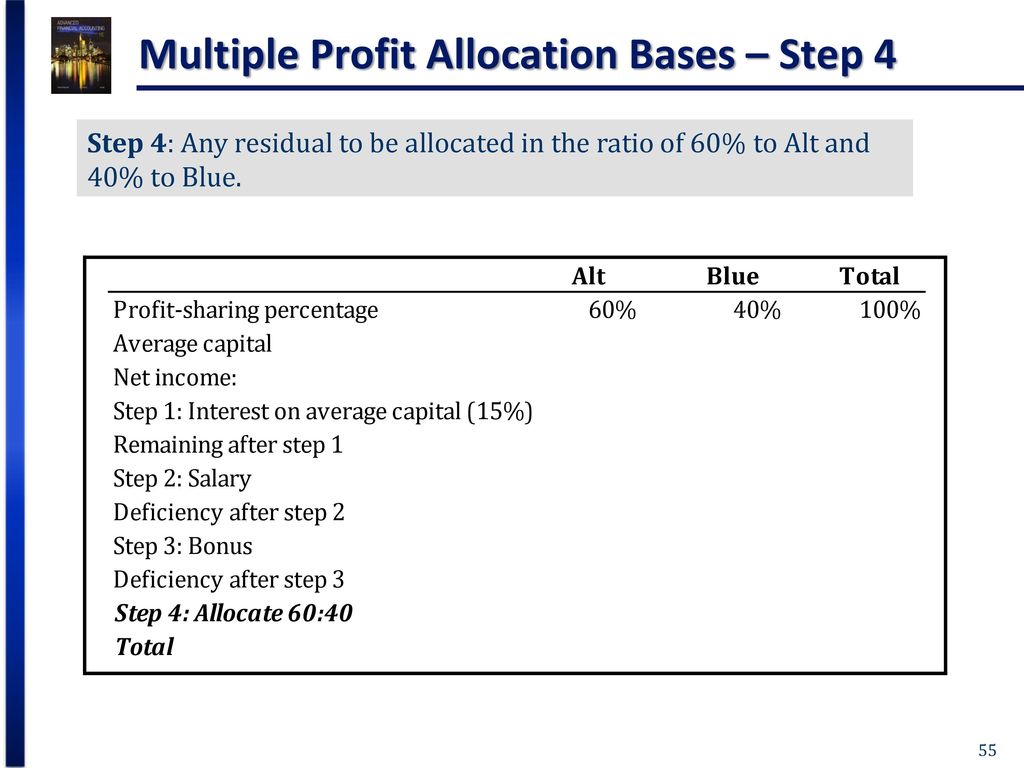

Partnerships Formation Operation And Changes In Membership Ppt Download

Partnership Deed Q 1 Q 6 Ch 2 Ts Grewal S 21 Class 12th

Distribution Of Profit In A Partnership Explanation Examples Finance Strategists

Solved The Partnership Agreement Of Angela And Dawn Has The Chegg Com

Q 1 What Are Provision Relating To Governance Of Right To Share

Partnership Operation And Termination

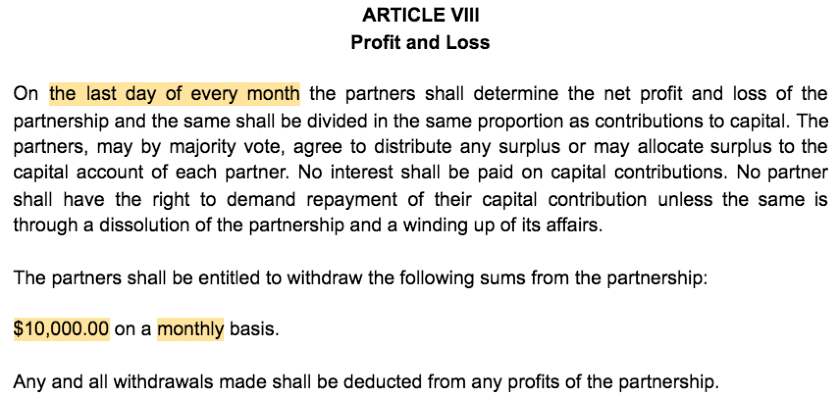

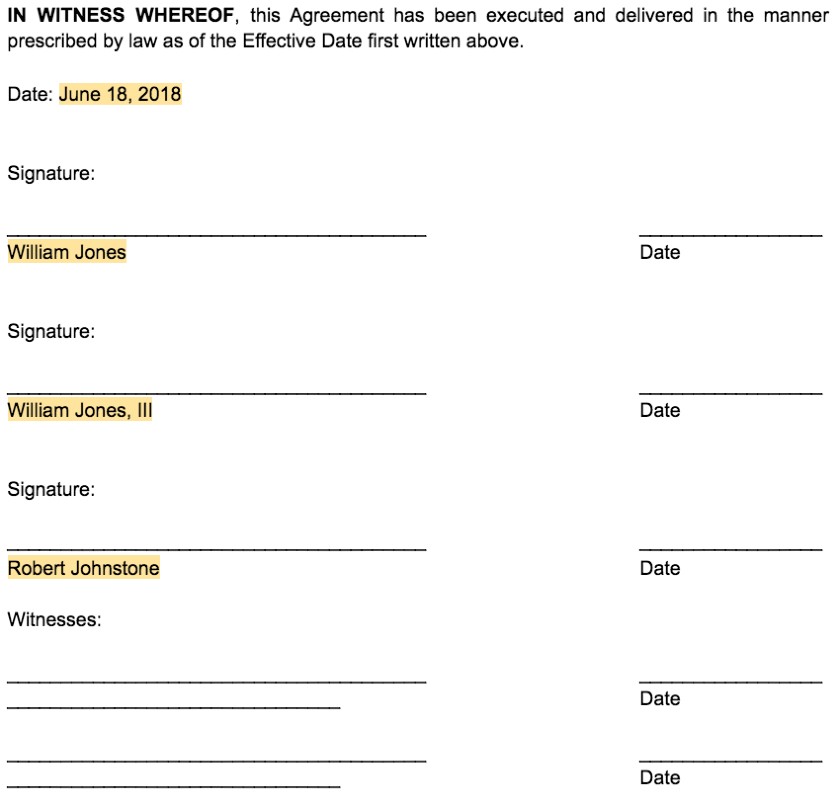

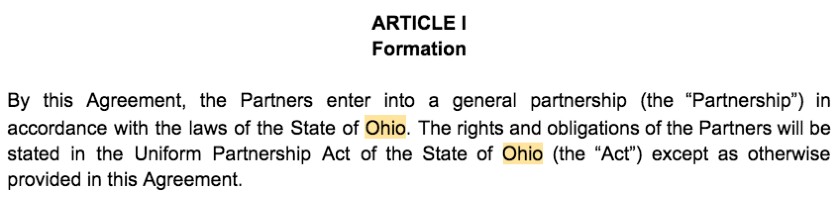

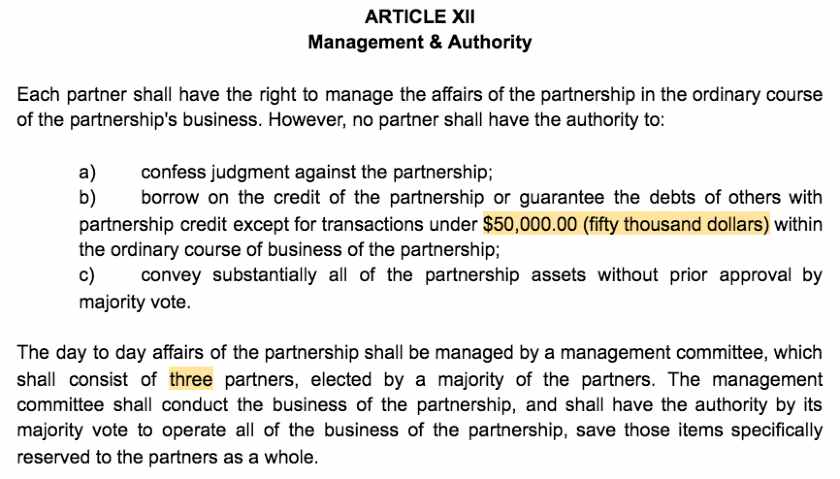

How To Create A Business Partnership Agreement Free Template

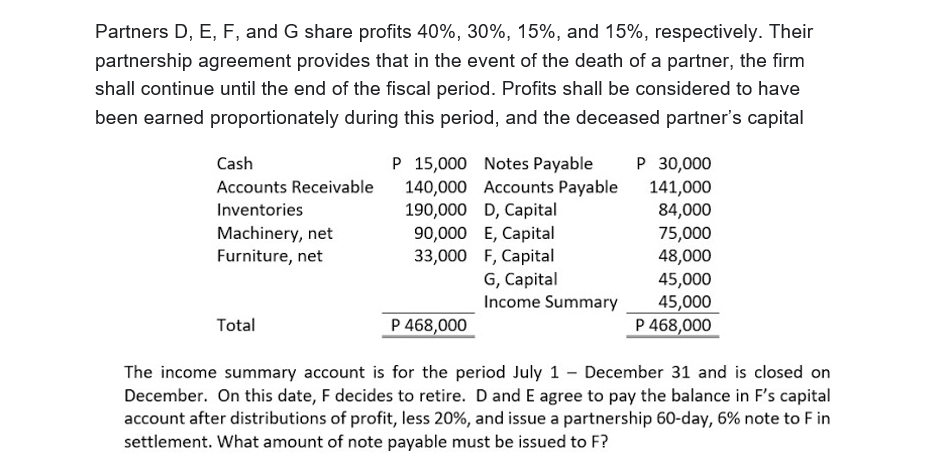

Solved Partners D E F And G Share Profits 40 30 15 Chegg Com

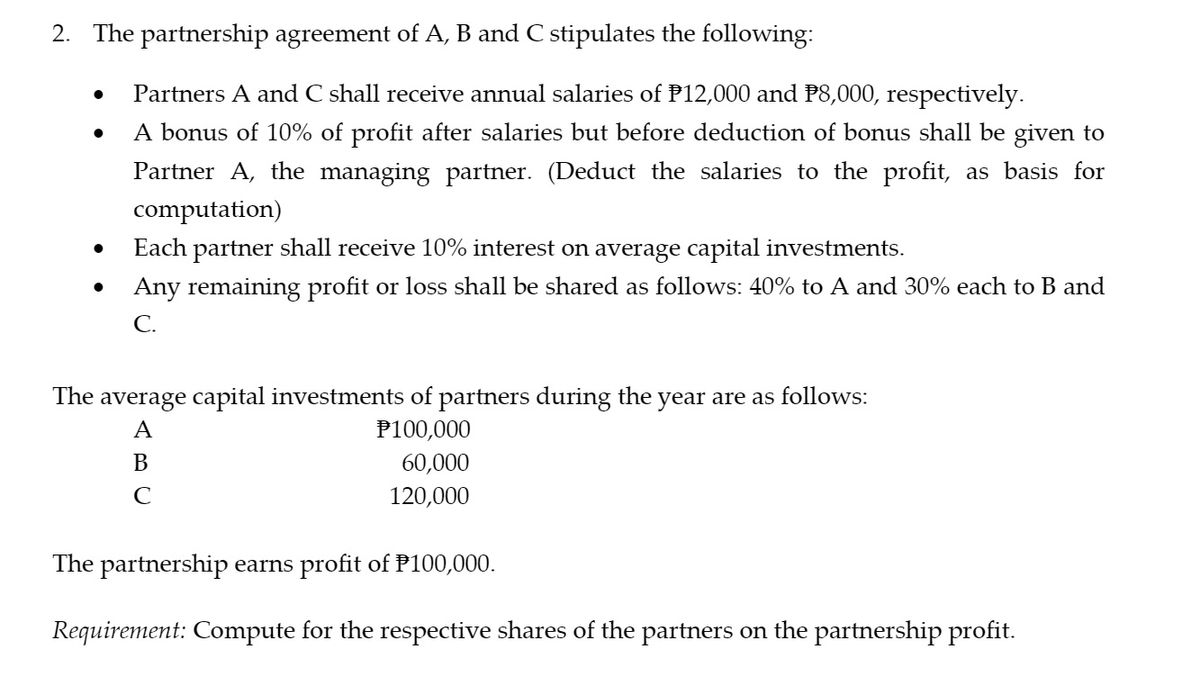

Answered The Partnership Agreement Of A B And C Bartleby

Free Partnership Agreement Create Download And Print Lawdepot Us

Free Partnership Agreement Create Download And Print Lawdepot Us

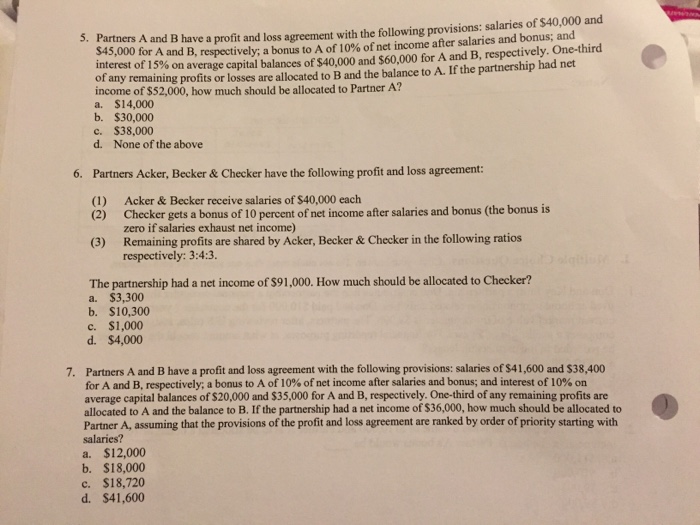

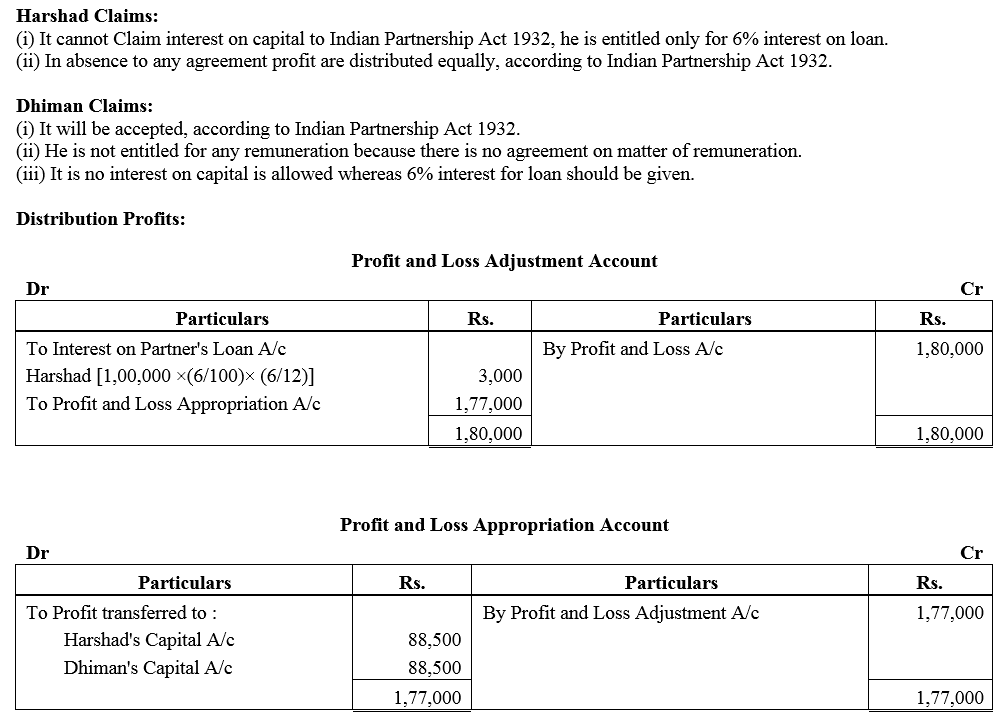

Solved Partners A And B Have A Profit And Loss Agreement Chegg Com

4 31 2 Tefra Examinations Field Office Procedures Internal Revenue Service

Remuneration To Partners In Partnership Firm Under 40 B

Lergp Com

S 1

Kirkland Com

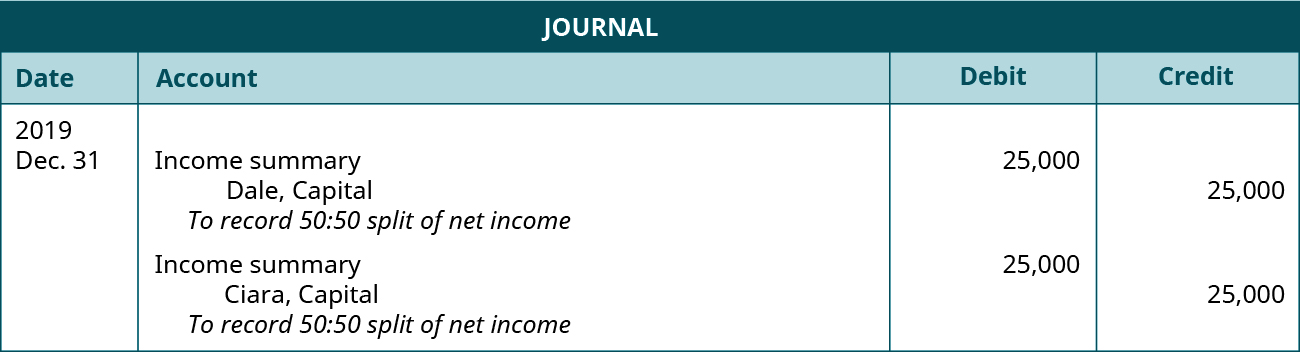

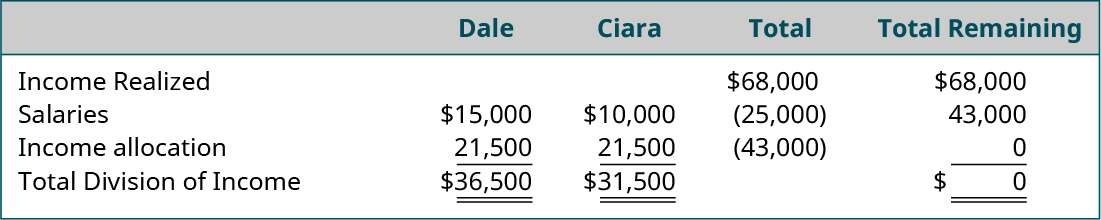

Compute And Allocate Partners Share Of Income And Loss Principles Of Accounting Volume 1 Financial Accounting

Free Partnership Agreement Create Download And Print Lawdepot Us

X Y And Z Are Partners In A Firm Sharing Profits In 2 2 1 Ratio The Fixed Capitals Of The Brainly In

General Partnerships Explained The Business Professor Llc

Revisor Mn Gov

Solved 9 Which Of The Following Statements Is Not True With Chegg Com

Irs Gov

Dk Goel Solutions Class 12 Chapter 2 Free Study Material

All You Need To Know About The Indian Partnership Act 1932

Accounting For Partnerships Ppt Video Online Download

Partnerships Formation Operation And Changes In Membership Ppt Download

How Big Firms Decide What To Pay Each Partner Precedent

S 1

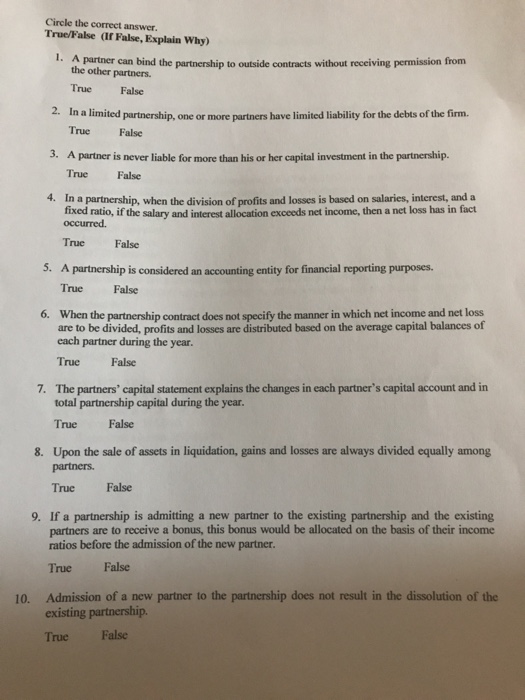

Solved Circle The Correct Answer True False If False Chegg Com

How To Create A Business Partnership Agreement Free Template

The End Of A Business Partnership

/GettyImages-1152013583-a5bad8090c064339bf7880b7c9012379.jpg)

Which Terms Should Be Included In A Partnership Agreement

Henryschein Com

Skofirm Com

Uniformlaws Org

Sharetngov Tnsosfiles Com

Topic 8 Partnership Part I

Partnership Agreement What It Is Nerdwallet

How To Create A Business Partnership Agreement Free Template

Solved Compute Total Income Of Each Partner For The Year Of Chegg Com

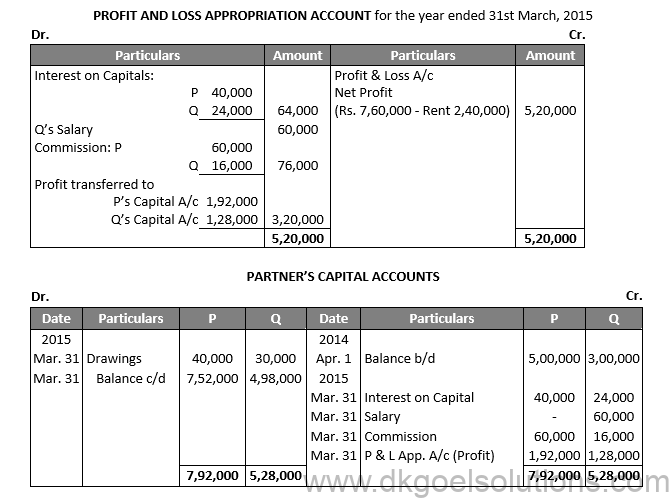

Profit And Loss Appropriation Account Accountancy Knowledge

Solved Regulations 1707 1 A C 1 704 1 B 1 V Chegg Com

Partnership Rules Faqs Findlaw

Tax Rules For Partnership Interest Changes Bader Martin

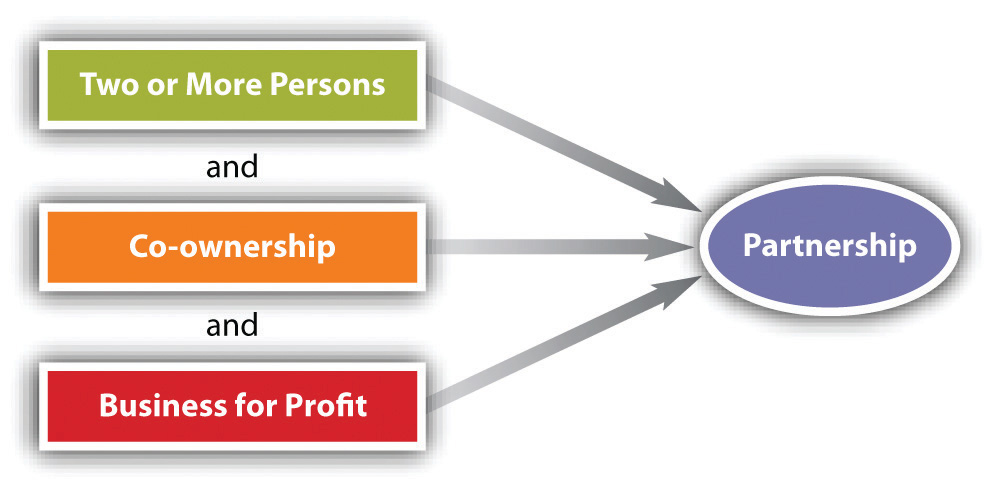

Partnership Definition Features Advantages Limitations

1

1

Rights Of Partner As Per The Indian Partnership Act 1932

Partnerships General Characteristics And Formation

How To Create A Business Partnership Agreement Free Template

Importance

Engagedscholarship Csuohio Edu

How To Create A Business Partnership Agreement Free Template

Imo Ie

Partnership Agreement What It Is Nerdwallet

How To Create A Business Partnership Agreement Free Template

X And Y Are Partners In A Firm X Is Entitled To A Salary Of Rs 10 000 Per Month And Commission Of 10 Sarthaks Econnect Largest Online Education Community

Pdf Beams Advacc11 Chapter Jose Ortiz Academia Edu

Rocket Companies Inc

Guide To Nonprofit Governance 19

S 1

Dcpmidstream Com

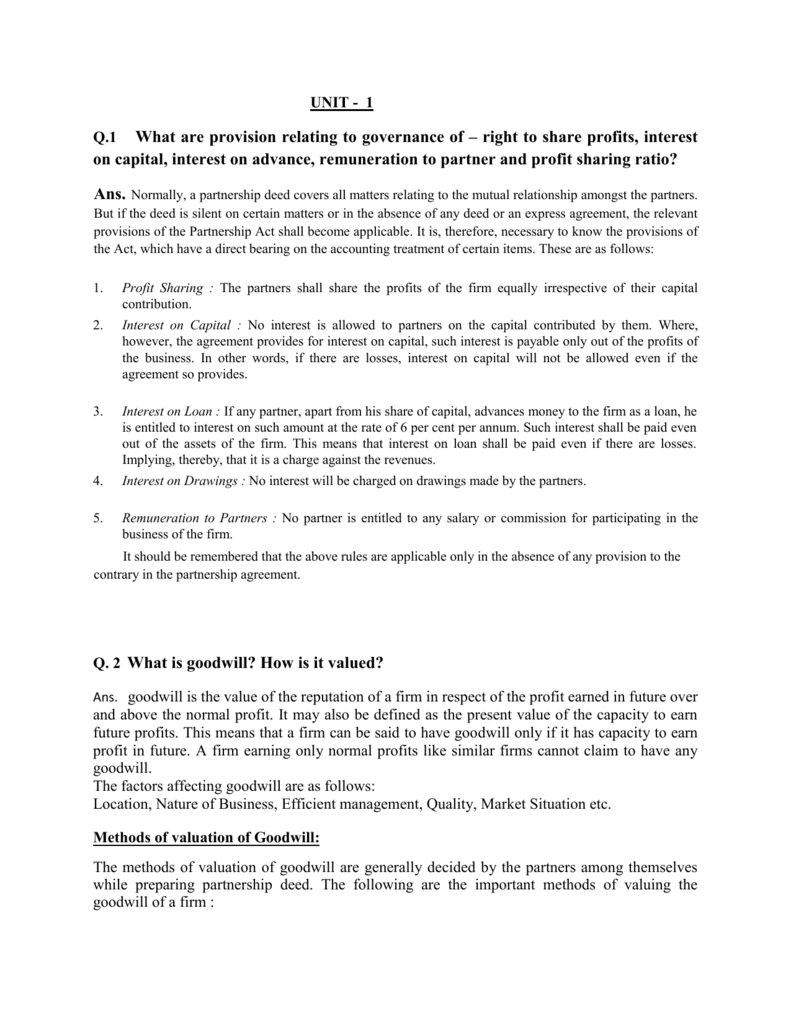

Solved Use The Following Information For The Next Three Cases The Partnership Agreement Of A B And C Stipulates The Following Partners A And C S Course Hero

8 Key Components Of Accounting Firm Partnership Agreements And Other Special Considerations Levenfeld Pearlstein Llc

Solved 68 Which Of The Following Statements Is False A Chegg Com

Ans D Capital A C Dr 0 C Capital A C Dr 100 And A Capital A C 300 42 Krishna Arjun And Bhim Are Partners In A Firm The Balance Of Their

Q 1 What Are Provision Relating To Governance Of Right To Share

In The Absence Of An Agreement Partners Are Entitled To

Solved 5 The Partnership Agreement Of A B And C Chegg Com

Pdfcoffee Com

Extwprlegs1 Fao Org

Americanbar Org

Profit And Loss Appropriation Account Accountancy Knowledge

Section 199a Deduction Strategies For Small Business Owners

Ts Grewal Solutions Archives Page 3 Of 5 Ncert Books

Irs Gov

Solved Partners A And B Have A Profit And Loss Agreement Chegg Com

Accounting For Partnerships

Distribution Of Profit In A Partnership Explanation Examples Finance Strategists

Compute And Allocate Partners Share Of Income And Loss Principles Of Accounting Volume 1 Financial Accounting

Partnership Definition Features Advantages Limitations

Ts Grewal Solutions Archives Page 3 Of 5 Ncert Books

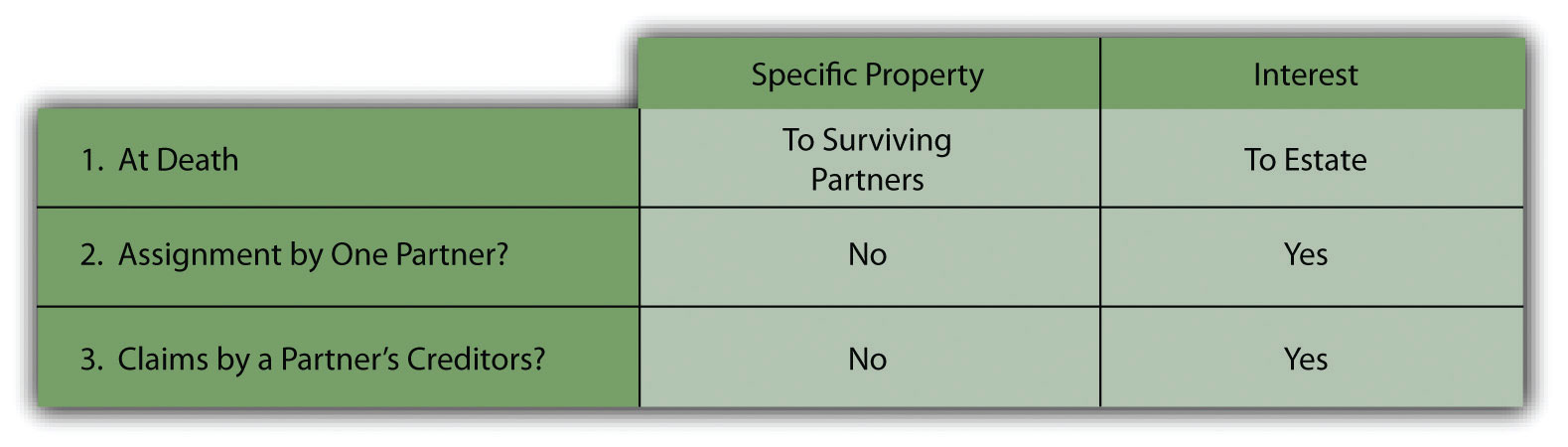

Operation Relations Among Partners

General Partnerships Explained The Business Professor Llc

Form S 1

Baylor Edu

What Every Nonprofit Board Member Should Know Adler Colvin

Financial Considerations For New Law Firm Partners Aba Law Practice Today

Interest Remuneration To Partners Section 40 B

In The Absence Of An Agreement Partners Are Entitled To

1

Tm 4 S1 None 70 s

Splitting The Pie Some Thoughts On Profit Sharing Among Partners Edge International

The Partnership Agreement Of A B And C Stipulates The Following Partners A And Course Hero

X And Y Are Partners In A Firm X Is Entitled To A Salary Of Rs 10 000 Per Month And Commission Of 10 Sarthaks Econnect Largest Online Education Community

Rights And Responsibilities Of Partners In A Partnership Firm Legalwiz In

Solved The Partnership Agreement Of A B And C Stipulates The Following Partners A And C Shall Receive Annual Salaries Of 12 000 And 8 000 Respec Course Hero

0 件のコメント:

コメントを投稿